Sometimes, creating a larger deposit can force a loan again within just conforming loan boundaries. When you don’t possess the upfront hard cash for a larger down payment, a piggyback mortgage loan might be The solution.

Borrowers who preserve additional on the first loan than they expend on the 2nd loan reap the benefits of piggybacking. Execs of a piggyback home finance loan:

Two property finance loan payments: Since you Have got a property finance loan and a home fairness line of credit score that needs to be paid each month, it’s like acquiring two home loans, While one particular are going to be Considerably smaller sized than the opposite just one. Once you have paid out off the HELOC, you will end up all the way down to one particular payment a month.

Again, your true expertise will depend on the rates you qualify for based on your credit rating score, debt-to-profits ratio, and cash flow stage. Your home finance loan lender will help you run the quantities and Examine fees for each option.

Set every month payment. You could get pleasure from a hard and fast interest price for the everyday living of one's loan, making it easier to estimate your whole borrowing costs and ongoing month-to-month payment.

Our home finance loan calculator might help guideline many of the decisions relevant to buying a household or refinancing your home loan, for example:

It’s crucial that you Observe that HELOC desire premiums are normally bigger than People for regular mortgages, which may offset several of the cost savings obtained through an eighty% house loan. Nevertheless, if the intention will be to pay back the HELOC in just a number of years, this will not be an important concern.

Extra curiosity than shorter phrases. A twenty-yr home loan even now has greater costs and total borrowing charges in comparison with a fifteen-12 months mortgage loan. You might want to take into account a shorter expression if you can manage the upper every month payment.

HELOCs have variable fascination premiums and regular payments, but their prices are generally reduce than household equity loans.

Finest credit rating cardsBest reward present credit cardsBest harmony transfer credit score cardsBest vacation credit rating cardsBest money back again credit rating cardsBest 0% APR credit score cardsBest rewards credit rating cardsBest airline credit history cardsBest school college student credit rating cardsBest bank cards for groceries

Plus they commonly qualify for lessen interest premiums. So there are real perks to creating an enormous deposit and having your LTV to eighty% or decreased. Having said that, you are able to qualify for just a mortgage loan having an LTV A great deal better than 80%. Occasionally, even a one hundred% LTV is allowable (which means you make no deposit in the slightest degree).

You may do the job at your personal tempo and a person is always there to reply your issues — 24 hrs daily, seven days each week. Want a quickly, practical way to get a house loan? Give Rocket Property finance loan® a check out.

Many people use a home finance loan calculator to estimate the payment website on a fresh mortgage loan, nevertheless it can be used for other applications, far too.

It is possible that the expense of simply just purchasing PMI may very well be cheaper than an eighty/twenty loan. Generally operate the numbers when buying a residence to view which mortgage option is the best for you.

Alana "Honey Boo Boo" Thompson Then & Now!

Alana "Honey Boo Boo" Thompson Then & Now! Ariana Richards Then & Now!

Ariana Richards Then & Now! Joseph Mazzello Then & Now!

Joseph Mazzello Then & Now! Marcus Jordan Then & Now!

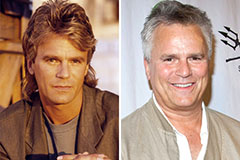

Marcus Jordan Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!